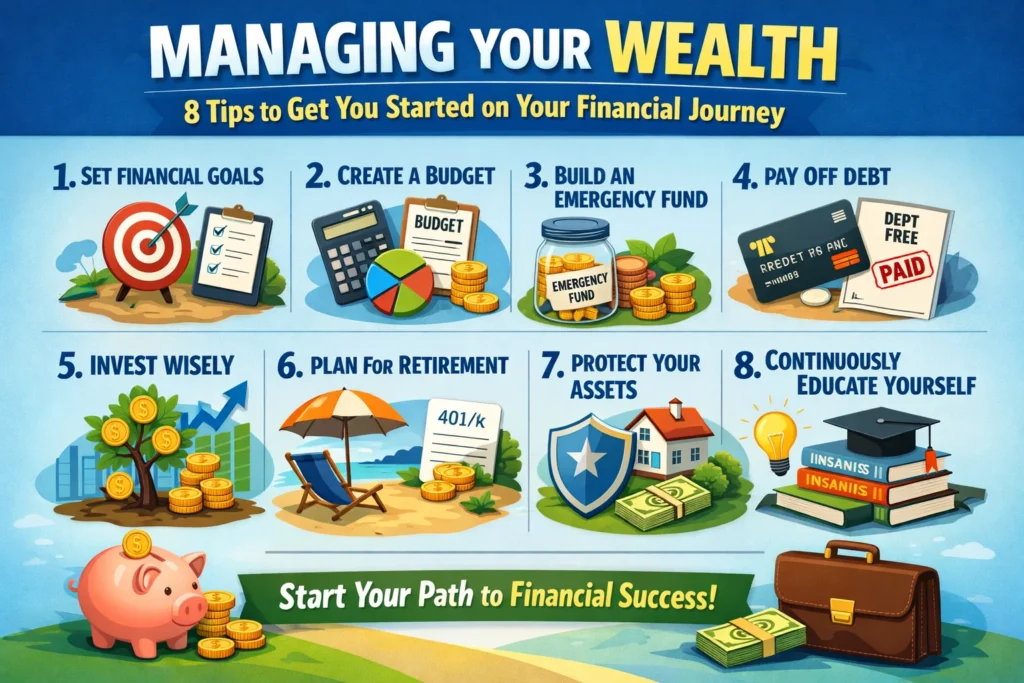

Building and preserving wealth isn’t just about making money, it’s about developing the discipline, strategy, and long-term thinking that transforms financial dreams into reality. Whether you’re taking your first steps in your career or working to maximize the resources you’ve already accumulated, smart wealth management practices can fundamentally reshape your financial future. Sure, the path to financial security won’t unfold overnight, but with the right mindset and consistent effort, you’ll create a foundation that supports lasting prosperity. These eight essential tips will help you cut through the complexity of wealth management and guide you toward the financial goals that matter most to you.

Establish Clear Financial Goals

Think of your financial future as a destination, you can’t get there without knowing where you’re headed. Defining specific, measurable objectives that truly reflect your values and lifestyle dreams gives every financial decision a purpose and direction. Without this clarity, you’re essentially wandering through your financial life, making choices without understanding whether they’re moving you forward or holding you back. Short-term objectives might include building that crucial emergency fund or saving for a dream vacation, while long-term goals could encompass retirement planning, purchasing real estate, or ensuring your kids’ education is fully funded.

Create and Maintain a Comprehensive Budget

Your budget is more than just a spreadsheet, it’s the financial control center that reveals exactly where your money comes from and where it goes each month. Start by tracking every single dollar for at least thirty days to get an honest picture of your current spending habits and uncover those sneaky areas where money seems to vanish. Break your expenses into categories: fixed costs like mortgage or rent, variable expenses such as groceries and utilities, and discretionary spending that can flex when needed. The popular 50-30-20 rule offers a straightforward starting point, direct 50% of your income toward necessities, 30% toward wants, and 20% toward savings and paying down debt.

Build a Robust Emergency Fund

Financial peace of mind starts with knowing you’ve got a safety net ready to catch you when life throws those inevitable curveballs. Establishing a fund that protects you from unexpected expenses and income disruptions means you won’t have to derail your long-term plans when emergencies strike. Most financial experts suggest keeping three to six months’ worth of essential living expenses set aside, though your personal situation might call for a more generous cushion. Keep this money in a highly liquid account, something like a high-yield savings account where it’ll earn some interest while remaining instantly accessible when you need it.

Prioritize Debt Reduction Strategically

Managing and ultimately eliminating debt frees up resources that can be channeled toward building real wealth and improving your overall financial health. Here’s the thing, not all debt affects your finances equally, so developing a smart, strategic approach to repayment can dramatically accelerate your journey toward financial freedom. High-interest consumer debt, especially those credit card balances, typically deserves your immediate attention since the interest charges compound quickly and can seriously undermine your wealth-building efforts. The debt avalanche method tackles debts with the highest interest rates first while maintaining minimum payments on everything else, ultimately saving you the most money in interest over time.

Invest for Long-Term Growth

Growing your wealth means putting your money to work through strategic investments that can outpace inflation and generate meaningful returns over time. Starting your investment journey early unlocks the incredible power of compound interest, where your earnings begin generating their own earnings in an accelerating cycle that builds real wealth. Spreading your investments across different asset classes, stocks, bonds, real estate, and alternative investments, helps you manage risk while pursuing returns that align with your goals and comfort level with market fluctuations. Tax-advantaged retirement accounts like 401(k)s and IRAs offer a great starting point, providing immediate benefits while systematically building your future nest egg. If your employer offers matching contributions to retirement plans, take full advantage, it’s essentially free money you can’t afford to leave sitting on the table. As your wealth expands and your financial picture becomes more sophisticated, professionals navigating complex investment strategies and retirement planning often work with Denver private wealth management specialists who help optimize their approach and confidently navigate market volatility.

Protect Your Assets with Appropriate Insurance

Safeguarding the wealth you’ve worked so hard to build requires comprehensive insurance coverage that shields you from potentially catastrophic financial losses when things go wrong. Health insurance stands between you and medical expenses that could otherwise wipe out your savings in a matter of months. Disability insurance replaces your income if illness or injury prevents you from working, a critical protection that many people overlook until it’s too late. When others depend on your income, life insurance becomes essential, providing the financial security your loved ones need if something happens to you.

Optimize Your Tax Strategy

Minimizing your tax burden through smart, legal planning means you keep more of your hard-earned money working toward your financial goals rather than unnecessarily enriching government coffers. Understanding how different income types, investments, and accounts get taxed empowers you to make decisions that genuinely reduce your overall tax liability. Contributing to tax-advantaged retirement accounts delivers immediate deductions or tax-free growth, depending on whether you opt for traditional or Roth structures. Tax-loss harvesting, strategically selling investments at a loss to offset capital gains, can reduce your taxable income while keeping your overall investment strategy intact.

Commit to Continuous Financial Education

The financial world never stands still, new investment vehicles emerge, regulations change, economic conditions shift, and wealth management strategies evolve in ways that can significantly impact your financial success. Investing time in expanding your financial knowledge empowers you to make smarter decisions, recognize opportunities others miss, and sidestep costly mistakes throughout your wealth-building journey. Dive into books, articles, and reputable financial publications that keep you informed about personal finance topics, investment strategies, and economic trends affecting your bottom line. Workshops, seminars, and webinars offered by financial institutions, professional organizations, and educational platforms provide deeper dives into specific topics that matter to your situation.

Conclusion

Successfully managing your wealth demands a comprehensive approach that addresses multiple dimensions of your financial life while keeping your long-term objectives front and center. Implementing these eight fundamental strategies creates a flexible framework for financial success that adapts as you move through different life stages and face new challenges. The journey toward financial security and prosperity requires patience, discipline, and consistent effort, but the payoff, true financial independence and genuine peace of mind, makes every bit of that commitment worthwhile. Wealth management isn’t something you do once and forget about; it’s an ongoing process requiring regular attention, honest evaluation, and willingness to adjust course as your life unfolds.For anyone who wants to keep learning about personal finance, investing, and smart money decisions, My Blogs Network is a great place to explore more practical guides and insights. You can find a wide range of helpful articles and resources at that support your journey toward better financial planning and long-term wealth building.